philadelphia wage tax return

The Department of Revenue has provided important reminders regarding the new. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which.

What To Do If You Receive A Missing Tax Return Notice From The Irs

How to file and pay City taxes.

. Non-residents who work in Philadelphia must also pay the Wage Tax. The City Wage Tax is a tax on salaries wages commissions and other compensation. These are the main income taxes.

The first due date to file the Philadelphia Wage Tax return quarterly is May 2 2022. Yes you claim a credit for taxes paid to Philadelphia on your NJ return. Do I have to file a Philadelphia wage tax return.

A 245 user fee will be added to the amount due when paying by credit card. When no Wage Tax is deducted from an employees paycheck Philadelphia residents are responsible for filing and paying the Earnings Tax. The Earnings Tax and the Wage Tax refer to the same tax and an employer with nexus in Philadelphia will normally withhold and remit the Philadelphia Wage Tax on its employees.

OUT-OF-STATE TAX CREDIT WORKSHEET. The deadline is weekly monthly semi-monthly or quarterly depending on the amount of Wage Tax. Wage taxes paid to Philadelphia may apply as a credit directly against local tax liability.

You will need to file Schedule. Your SSNEIN or Philadelphia tax account number. The tax applies to payments that a person receives from an employer in return for work or services.

Because of COVID I will be able to work from home for nine months of the year in 2020. To compute your credit for taxes paid to Philadelphia access the Local Earned Income Tax Return form and refer to LINE 12. Earnings Tax employees Due date.

For specific deadlines see important dates below. Interest penalties and fees. Out-of-state employers arent required to withhold this tax thus the employee will need to file the Employee Earnings Tax Return to ensure the tax is paid on their wages earned within the city.

Pay delinquent tax balances. You can claim a tax credit pro-rated dollar for dollar for Philadelphia City wage taxes paidwithheld appearing on your W-2 box 19 and 20. April 1 2022 in Client News Alerts Tax by Adrienne Straccione.

To qualify your income must be subject to both the New Jersey income tax and the income or wage tax imposed by another jurisdiction outside of New Jersey for the same year. Cities arent covered by reciprocity which is why Philadelphia was withheld. Make an appointment for City taxes or a water bill in person.

In response Mayor Jim Kenney is proposing a reduction in the citys oft-criticized wage tax. You can also file and pay Wage Tax online. E-check payments are free of charge.

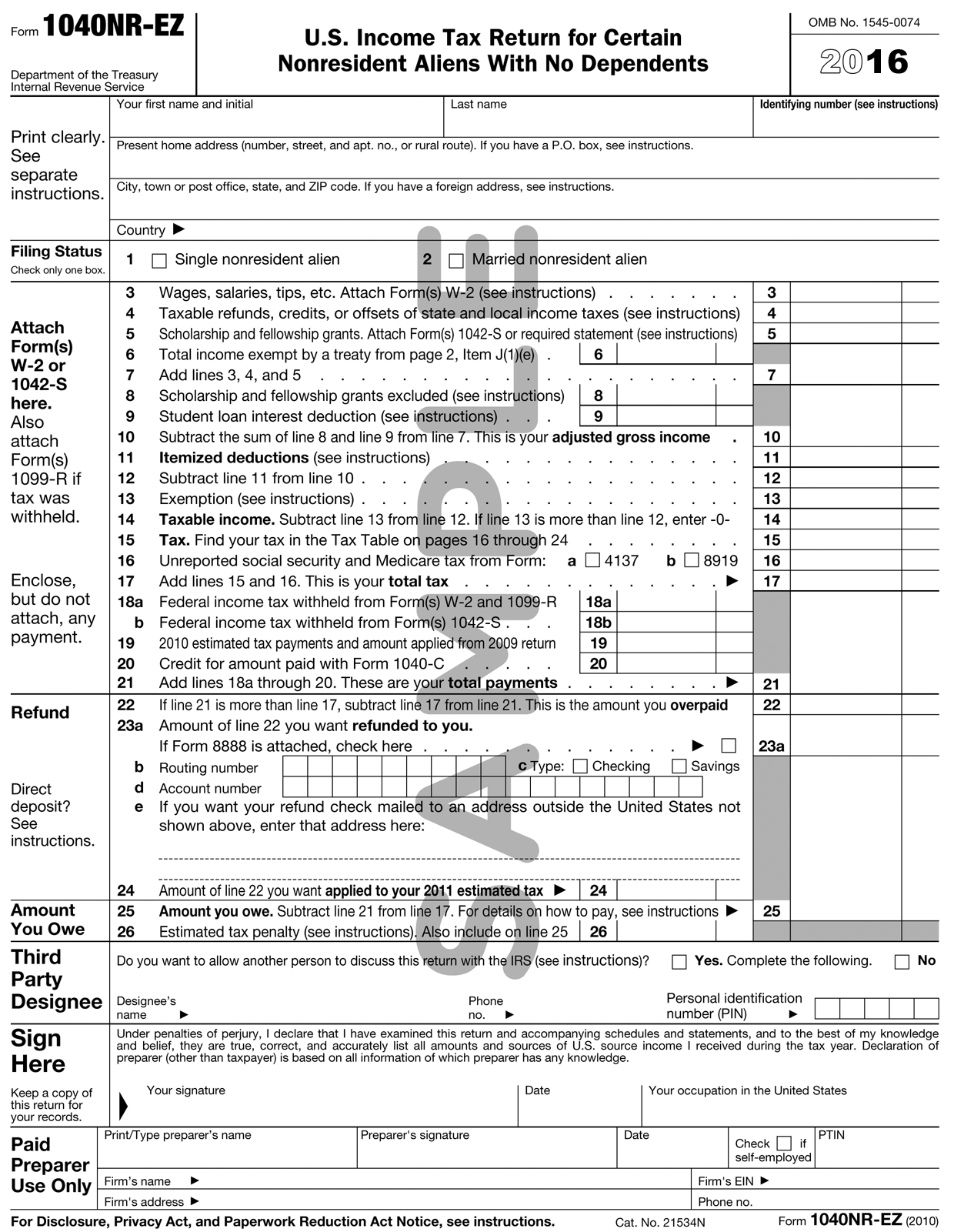

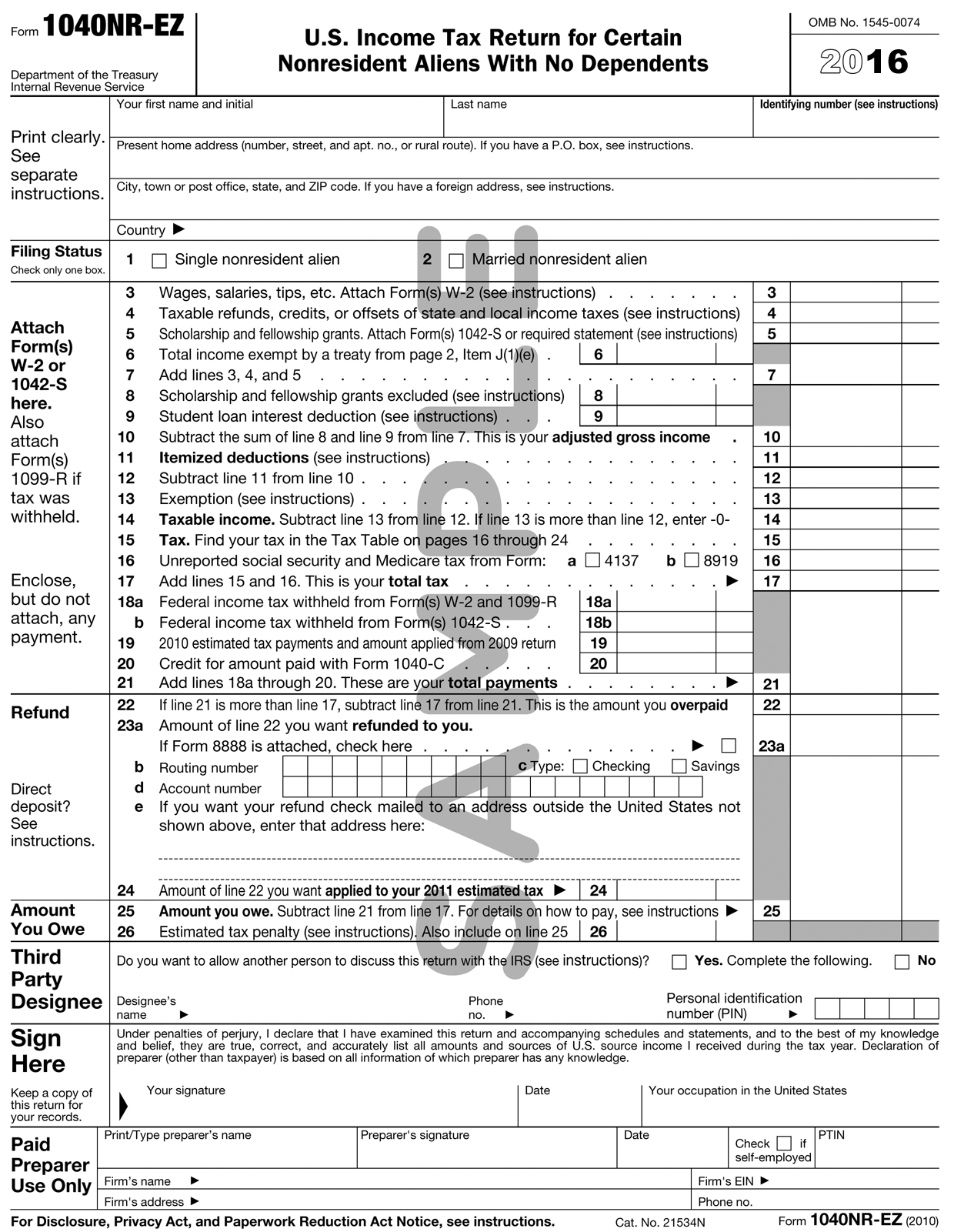

There will be a user fee of 595 when paying by VISA Debit Card or MasterCard Debit Card. Who Must File Philadelphia tax return. These forms help taxpayers file 2021 Wage Tax.

All Philadelphia residents owe the Wage Tax regardless of where they work. Individuals who have paid municipal wage tax under these instances will be able to receive a refund from the City of Philadelphia. The current wage tax rate in the city is 34481 percent.

Do I have to file a Philadelphia wage tax return. Non-residents who work in Philadelphia must also pay the Wage Tax. Tax forms instructions.

How do I go. Your Department of Revenue PIN number. 2021 Wage Tax forms.

Philadelphia City Income Taxes to Know. Instructions for filing an annual reconciliation for 2021 Wage. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

Philadelphia Employee Earnings Tax Return. It is possible that residents of Philadelphia who are working out-of-state will be compelled to file and pay a municipal income tax in their place of employment in addition to. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation.

It is possible that residents of Philadelphia who are working out-of-state will be compelled to file and pay a municipal income tax in their place of employment in addition to. The credit will only apply to the tax paid on wages earned in Philadelphia. Tax due on these returns or bill can be paid with a credit card or E-Check.

The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate of 35019 percent 035019. Every individual who is a resident part-year resident or nonresident who realizes income producing 1 or more in tax is required to submit a Pennsylvania Income Tax Return PA-40 even if no tax is owed eg when an employee receives compensation where tax is withheld. To pay taxes through our eFileePay portal you will need.

Quarterly plus an annual reconciliation. NJ and PA have reciprocity so residents only pay state tax to their home state. Use this form to file your 2021 Wage Tax.

Also known as the Wage Tax it is typically withheld and remitted by employers with nexus in Philadelphia and employees working for employers who withhold and remit 100 of. The Employee Earnings Tax is a tax on salaries wages commissions and other compensation paid to an individual who works or lives in Philadelphia. She also paid Philadelphia wage tax.

From now on you can complete online returns and payments for this tax on the Philadelphia Tax Center. Your PIN is generated by the City when you register your business online. Your banks nine digit routing number and your savings or checking account number.

20 rows Semi-monthly and weekly filers must submit their remaining 2021 Wage Tax returns and payments. All Philadelphia residents owe the City Wage Tax regardless of where they work. It is customary for me to get a credit on my New Jersey income tax return for the Philadelphia municipal wage taxes I have paid.

Pay Outstanding Tax Balances. For residents and 34481 for non-residents. For city residents the wage tax would decrease from 384 to 37 under Kenneys proposal.

Electronic funds transfer EFT Modernized e-Filing MeF for City taxes. In an email sent out today the City of Philadelphia Department of Revenue announced an increase in the wage tax for non-residents which will take effect on July 1 2020. When no Wage Tax is deducted from an employees paycheck Philadelphia residents are responsible for filing and paying the Earnings Tax.

However you should have a W2 showing NJ taxes withheld. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly. What is the amount of Philadelphia City wage tax.

Tax Refund Schedule Are Federal Tax Refunds Delayed In 2022 Marca

Company Secretarial Service Is Necessary For All Companies Be It Private Or Public Accounts Department Is Signific Business Tax Accounting Services Investing

Need A Payment Plan For Your Income Taxes Tax Attorney Tax Day Tax Refund

How To Read And Respond To Your Notice From The Irs Irs Reading Internal Revenue Service

Good Morning And Happy Saturday Tax Quote Quotes Quoteoftheday Tax Quote Tax Refund Quote Of The Day

Fillable Form 1040 Individual Income Tax Return Income Tax Return Income Tax Tax Return

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Tax Return Form Close Up Of A United States Tax Return Form With A Pencil And C Sponsored Form Close Tax Tax Deductions Tax Return Income Tax Return

Payroll Tax Suspension To Start In September Will Increase Employee Take Home Pay 6abc Philadelphia Payroll Taxes Quickbooks Payroll Tax Planning

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Income Tax Return Form Bd Fill Online Printable Fillable Blank Pdffiller Income Tax Income Tax Return Tax Forms

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Business Plan Template

Criminals Are Putting Old Tax Returns Up For Sale On The Dark Web Tax Forms Tax Season Income Tax Return

Important Tax Information And Tax Forms Camp Usa Interexchange

About A Tax Experts Llc Nick Ananin Jd Ea Filing Taxes Trucking Life How To Plan

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

File For Missing Stimulus Funds On Your 2020 Tax Return On Cheddar Tax Return Tax Federal Income Tax

The Equity Risk Premium More Risk For Higher Returns Equity Business Analysis Safe Investments

Income Tax Return Forms Ay 2018 19 Fy 2017 18 Itr1 Income Tax Return Income Tax Tax Forms